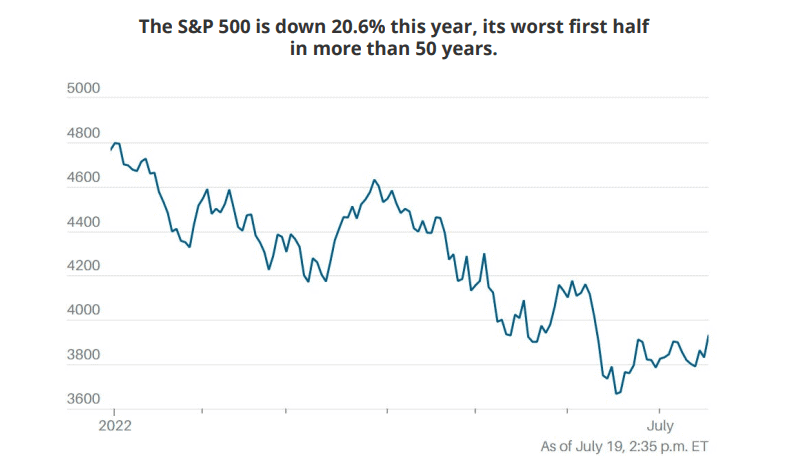

After a tumultuous first half for public markets in 2022, many investors are understandably on edge. There are geopolitical conflicts, record inflation, supply chain and labor concerns, and it seems like every talking head mentions an impending recession. Of course, it is easy to be concerned while watching the S&P 500 have its worst first-half performance since 1970, and many are bracing for the impact that is yet to be seen in private markets. Studies of past crises have shown impressive resiliency by the private equity industry, so how much concern should there be this go around?

In 2020, we touched upon the resiliency of private markets as the COVID-19 pandemic was raging through the world. Markets were highly volatile, and investors were similarly concerned then. In this note, we highlighted the risk mitigating factors of private equity, which included return comparisons during prior recessionary periods, and the readiness of capital in private markets by reliable investors and lenders. Both of these factors have subsequently continued to prevail proving the ability of private equity to outperform public markets in times of economic instability and market downturns. While past results are not indicative of future performance, time will tell if these trends will continue.

Private Equity Outperformance During Past Crises

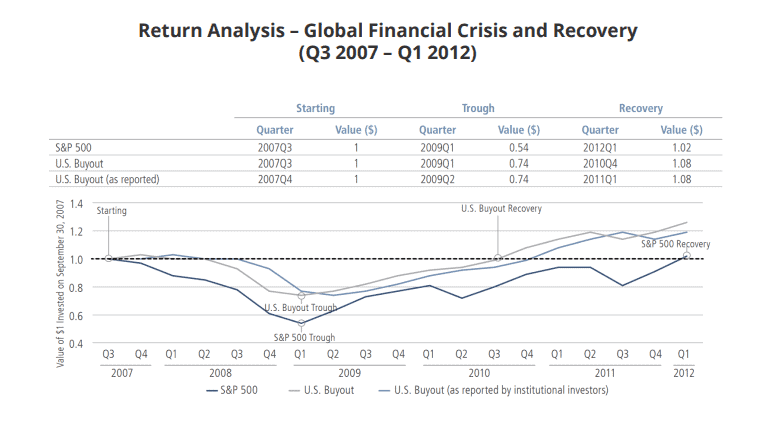

Private equity has typically outperformed public markets during times of market downturn. One such study, The Historical Impact of Economic Downturns on Private Equity, published by Neuberger Berman during the COVID-19 pandemic, found similar results. The chart below shows a quarter-by-quarter timeline for the value of the US buyout industry and the S&P 500 over the course of the Global Financial Crisis and following recovery periods

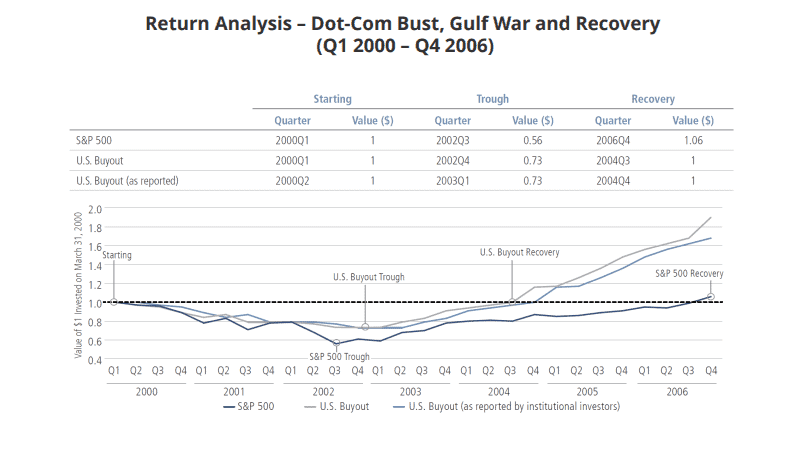

The chart above shows that US buyout funds experienced approximately half of the maximum drawdown that the S&P 500 experienced, down 28% relative to 55%. More telling is the time it took for these diversified private equity portfolios to recover as compared to the S&P 500, even with a sharper immediate rebound in public markets. While the full recovery for private equity took about 18 months, public markets took close to 3 years to reach their breakeven points. This thesis holds true not only for the Great Recession but can also be seen going back to the dot-com bubble and the period after September 11th leading to the second Gulf War.

Reasons For PE Outperformance

Throughout these times of market downturn, Neuberger Berman notes that the insulation that private equity has from public market sentiment helped reduce the decline in valuation, while the influence that private equity funds have over their portfolio companies and their ability to enact business, financial, managerial, and operational changes within them increase value and shorten the time to recovery.

A more recent article by Fortune echoes this reasoning for private equity’s outperformance. Private equity’s “active management approach and operational support give … businesses a competitive advantage as they respond to crises more quickly.” The best performing private equity firms typically utilize senior advisors with significant industry expertise to help address issues and implement the operational support needed for underlying portfolio companies to succeed.

Record Dry Powder

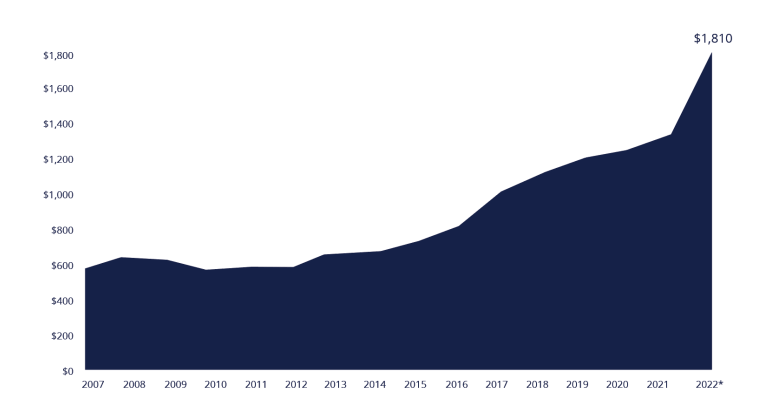

Meanwhile, the readiness of capital remains at an all-time high, with private equity firms raising record amounts of capital in recent years. As of the first quarter 2022, private equity firms are reportedly armed with more dry powder than they have ever had, with global uncommitted capital reaching a new record of $1.81 trillion in reserves, growing approximately 17% since 2015. This type of industry war chest, coupled with prudent deal management, has the ability to increase the precision of a firm’s strategy. This has also enabled some managers to take advantage of downturns, capitalizing on potentially discounted opportunities for companies that were well equipped to withstand or even benefit from the market situation, but whose valuations suffered due to overall risk-off sentiments in the market.

Within private markets, it is not only the record amount of dry powder in private equity that can help smooth the landing, but also the vast availability of capital within the private debtmarket. Pitchbook reported that private debt funds raised $191 billion in 2021 to keep up with the demand from both investors and borrowers. According to the report, the “accelerating trend of leveraged buyouts relying on private financing as opposed to bank loans or high-yield bonds has helped fuel the strategy’s rise.” With both an abundance of deployable capital held by the funds, as well as the amounts held by those ready and willing to loan to the funds at attractive rates, there is no shortage of capital that private equity and credit funds may utilize to take advantage of potential deals that appear during market turmoil.

Conclusion

As shown by the historical performance over the last several market downturns, the private capital markets have shown resiliency and are poised to take advantage of various potential opportunities. As we frequently expound upon, manager selection matters. The importance of picking disciplined funds, with managers who have navigated through many types of economic and market dislocations cannot be overstated. Indeed, private equity managers often require the discipline to find and support good companies with opportunities of longterm value creation. Yet even with careful manager selection, the future performance of any private equity investment is never guaranteed and comes with inherent risks that should be fully understood by financial advisers and their investors. By working with these types of institutional managers who generally have proven track records of successfully navigating multiple and varied market cycles, investors may be able to weather certain market volatility over the long run.