For most Americans, few of us have ever known a stagflationary macroeconomic environment. And for over a decade, the U.S. has benefited from consistent (if at times low) GDP growth, with only brief and temporary blips along the way. While we have been lucky to experience stable inflation for the last forty years, with prices rising at ~9% annualized, and the recent news of two consecutive quarters of negative GDP growth, it is becoming increasingly clear that the economy is headed towards a new regime. Since the 2008 crisis, whereas we had experienced largely low inflation coupled with low to medium GDP growth, our environment is shifting towards high inflation and slowing-and-shrinking economy. With recent economic trends conducive to a low and flattening rate environment, this regime change is now pointing us towards a rising and steepening rate environment. And while the old regime was supportive of both equity valuations and bond prices, economic numbers and forecasts have weakened the outlook for publicly traded equities and bonds, in particular passive strategies, leaving investors and their advisors with few opportunities to capture alpha. In this new regime, many advisors, economists, and forecasters postulate that

investors may want to turn to active management strategies.

The Economic Outlook

As the Federal Reserve and other economists continue to forecast, as well as recently published data, the inflation outlook continues to accelerate higher. Since the end of the Bretton Woods system of international financial exchange, wherein many of the world’s developed economies dropped their currencies peg to gold, the Federal Reserve has been liberated from the dollar’s peg to gold to influence interest rates to achieve its dual mandate of full employment and low-and-stable inflation. As a matter of economic orthodoxy, in an inflationary environment, the Federal Reserve seeks to reduce the supply of money in an economy to reign in price rises. Historically in times when the Fed finds itself facing hyperinflation (by American standards), the Fed’s primary tool to reduce the monetary supply is through raising rates – however, this has several knock-on effects that permeate through the financial system.

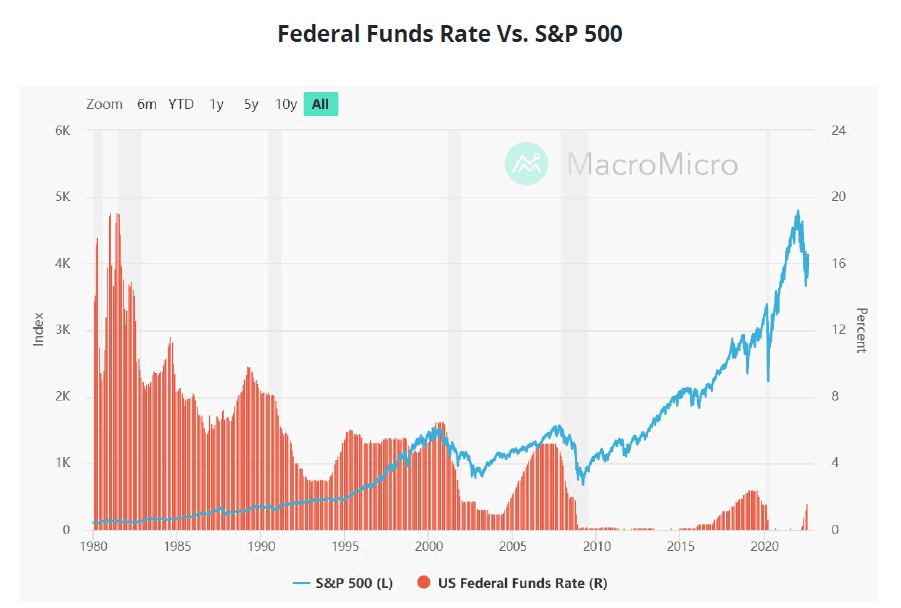

First, as a matter of financial math, as interest rates rise, the Net Present Value of equity valuations drop – a relationship that has historically played out vs the S&P500:

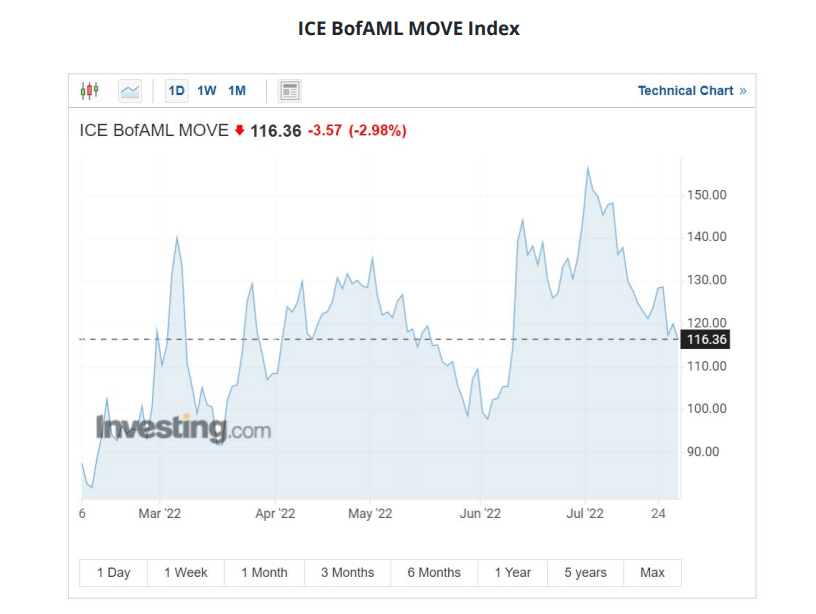

As a further matter of financial math – as rates rise, bond prices fall. But as rates rise, particularly from their recent lows of ~0%, the available range that fixed income assets can trade widens, and in turn, both implied and realized interest rate volatility increase, as indicated by the Bank of America MOVE index, a measurement of the volatility of US Treasuries

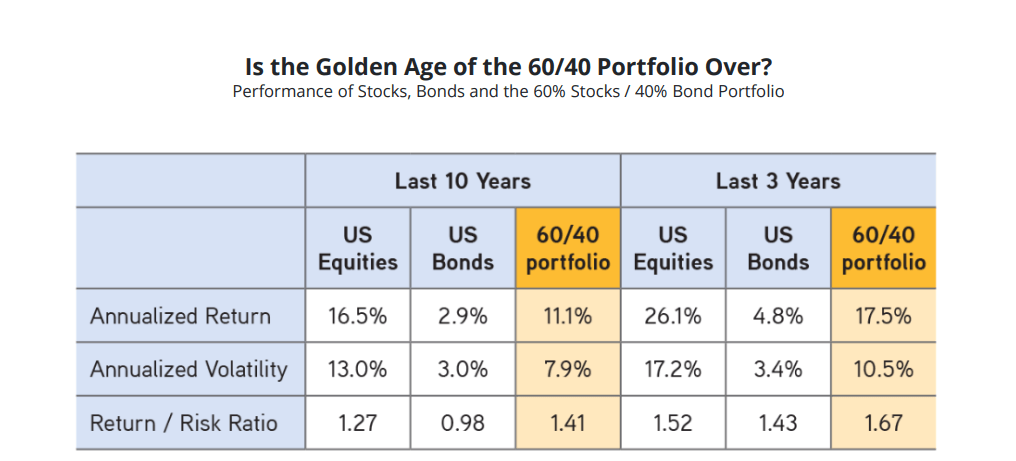

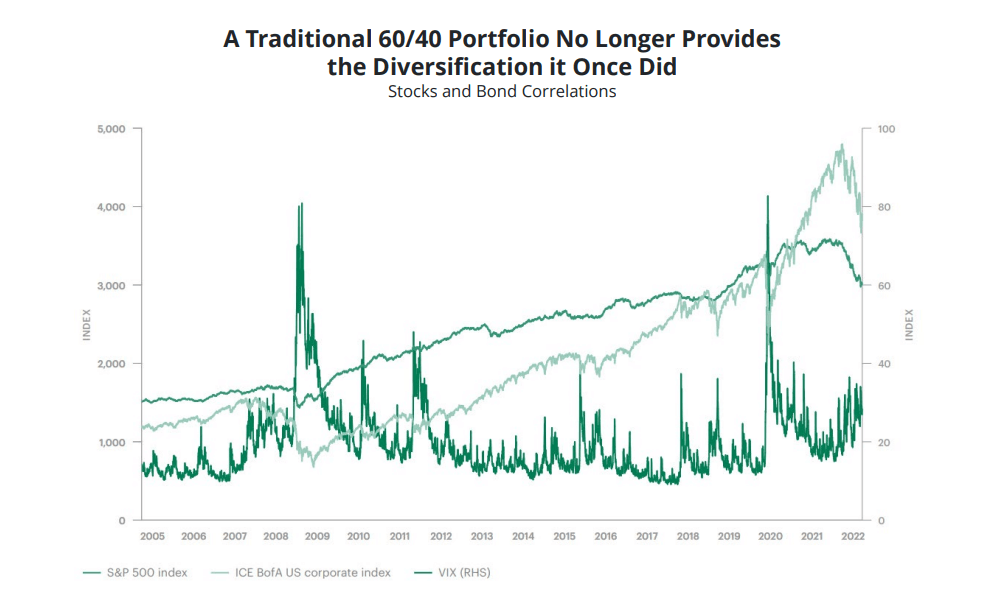

So what are some of the potential consequences of rising rates and volatility for an investor? In recent history, particularly in the post-Great Recession world, a traditional 60/40 passive investment approach generally reaped great gains, and performed with a relatively strong risk/return ratio. However, research shows that this strategy may no longer be capable of reaping the rewards that some investors have come to expect:

KKR and Regime Change

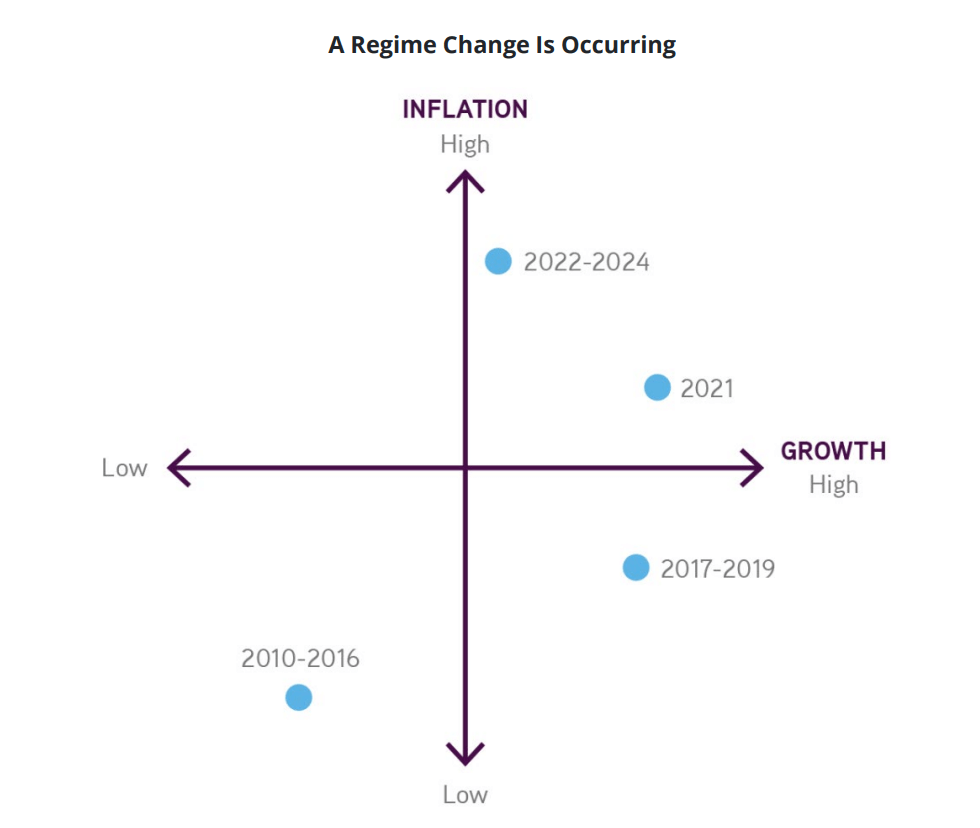

As highlighted in their recent report, “Regime Change: Enhancing the ‘Traditional’ Portfolio”, KKR takes a deep dive into the driving forces behind the success of the 60/40 portfolio for the last half generation, and the effects on such a strategy in our current economic environment. The biggest contributor to such success has been that at a fundamental level, a

60/40 portfolio (60% equities with 40% fixed income) has aimed to couple capital appreciation on the equity side as a consequence of our growing economy, with Fixed Income able to generate returns at times of market distress – key to that being the historical negative correlation between the two asset classes.

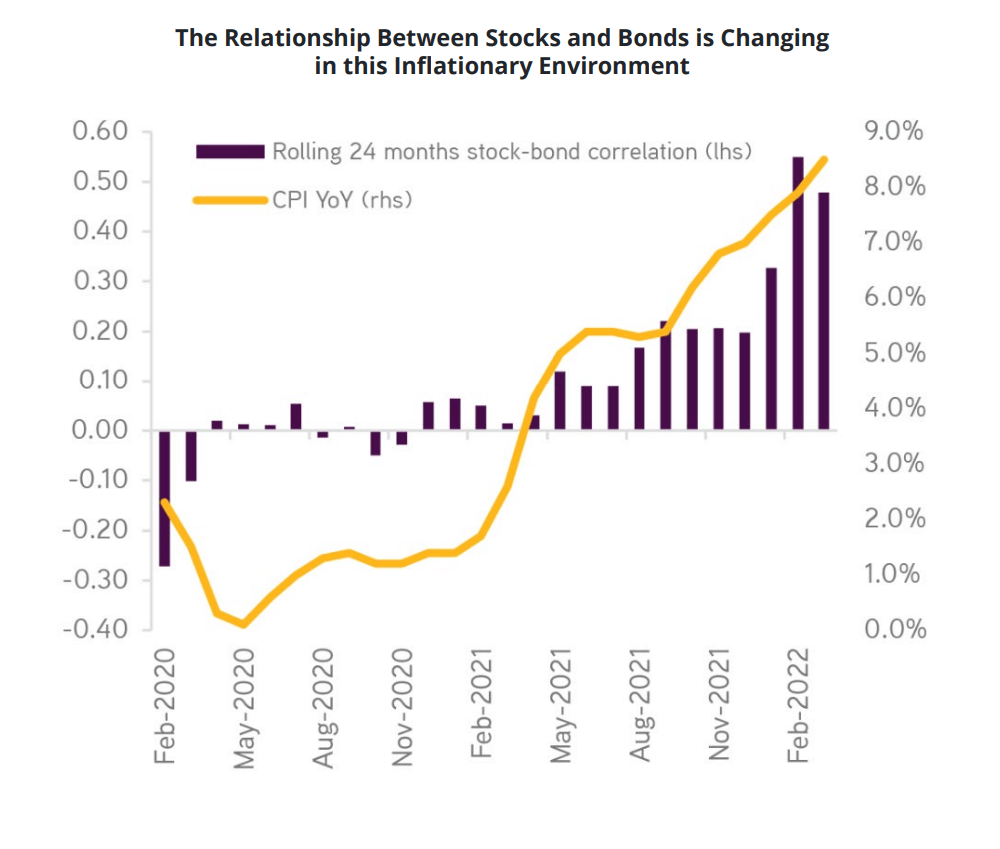

That negative correlation, however, is rooted in our “normal” economic environment, in which the Fed, largely for the last 40 years, has successfully achieved its low-and-stable inflation mandate. Low inflation has afforded the Fed the ability to keep rates low, goosing economic growth and in turn, the capital appreciation that has driven the success of public

equity markets. As inflation rises for the first time in nearly two generations, we have seen a fundamental shift to a “new normal”, has KKR emphasizes in the chart below:

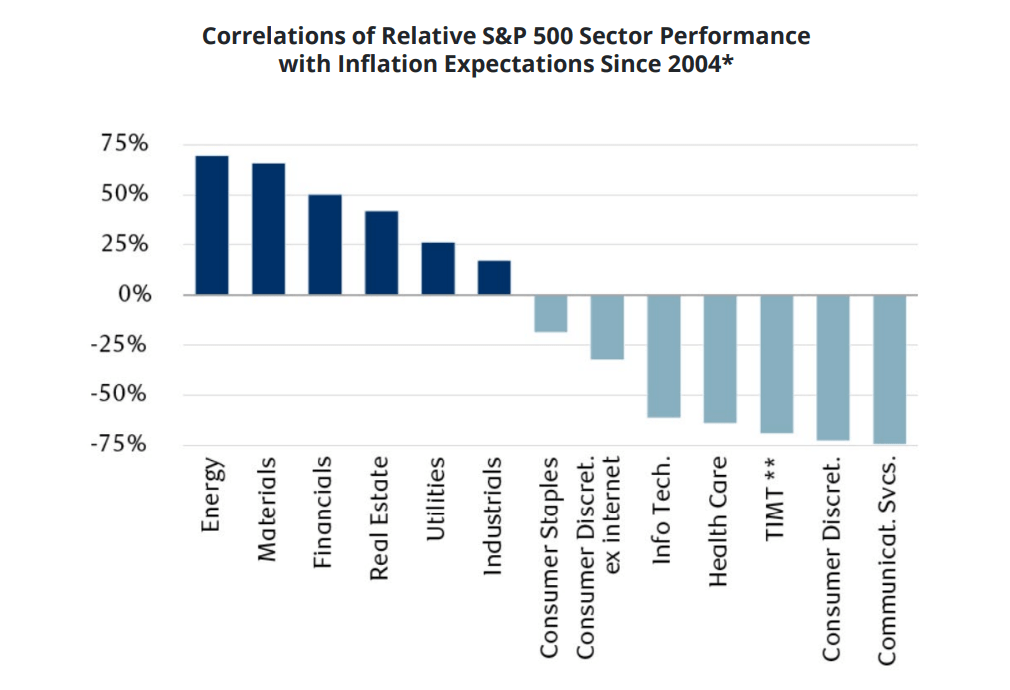

And this new normal for the economy has now changed the structural relationship of stocks and bonds, exacerbated by the rise in volatility. Already we have begun to see changes in the recent correlation between stocks and bonds this year. Construction of a successful portfolio that can capture alpha may therefore require a new approach to asset allocation. Historically, Public Equities have significantly underperformed, with a handful of sector outliers, namely “hard” assets, like commodities, real estate, and materials industries, as covered by RBC:

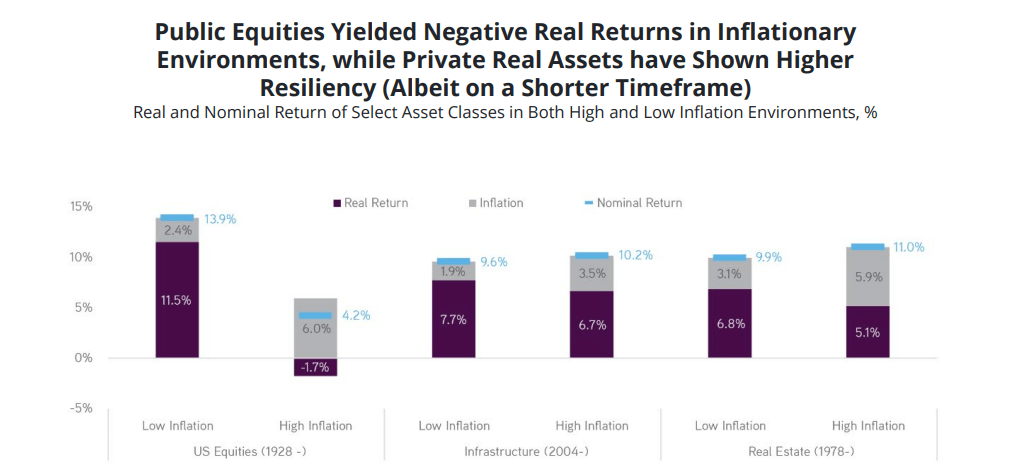

Moreover, as KKR further explains, the real returns of US equities have been negative in inflationary environments, while private “real assets” have outperformed:

If The 60/40 Portfolio Will Underperform, Where Can An

Investor Turn In This New Regime?

Most investors who have been using a traditional 60/40 portfolio may face two problems as a result of this regime: lower than expected returns, and increased volatility. To tackle these two problems, many investors are positing several solutions. On the equity side – at a base level, investors anticipating further distress in the public equity markets should consider an allocation to uncorrelated active management strategies. As Apollo recently argued in their whitepaper: “How alternatives can address your 60/40 blues” – public equity indices have become increasingly concentrated, leading to a higher beta amongst almost any portfolio of stocks, and effectively eliminating the diversification a 60/40 portfolio once provided:

As a result, for the “60” in a 60/40 portfolio, an allocation to a portfolio of alternative investments, including infrastructure, real estate, and LBO funds on the Private Equity side, and Global Macro and Equity Market Neutral funds on the Hedge side, may enhance future returns, and have historically provided greater risk-adjusted returns. On the fixed income half of the equation– Private Credit, with its quarterly pricing (removing the daily price volatility investors face in publicly traded fixed income assets) and the floating rate structure of private/leveraged loans may be the answer. (See our recent piece “Stagflation: Are Fixed Income Investors Ready”). With a diversified pool of floating rate assets, an investor in private credit lowers the rate risk of their “bond” portfolio in exchange for higher credit risk however, as KKR argues, this trade-off of exposure to higher credit risk and lower liquidity may be worth it: “While leveraged loans embed more credit risk than treasuries or mortgages, we believe that – in the face of the current interest rates outlook — tilting the balance between rates risk and credit risk offers a safer posture. Here again, going the private route via Private Direct Lending would allow investors to lock in an illiquidity premium (two to three percent) that could absorb the eventuality of lower growth driven credit losses.”

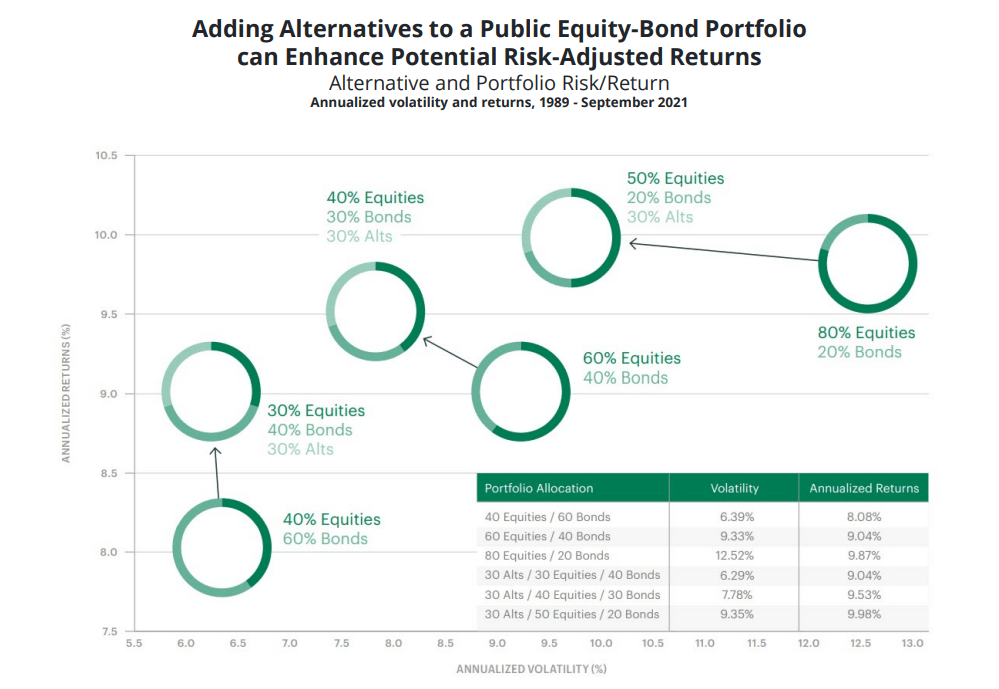

Overall though, with a combination of diversified alternative strategies, uncorrelated with each other and publicly traded equity and bond markets, has historically yielded a greater risk-return profile than a traditional 60/40, as Apollo acknowledges in the chart below:

Conclusion

While advisors and their investors have been able to reap immense financial rewards under the economic regime we have experienced in the wake of the 2008 Global Financial Crisis, and arguably since the hyperinflation/stagflation of the 70s and 80s, the new economic environment many economists and financial services professionals forecast for the near and medium term will present challenges. Rising inflation by definition substantially lowers real returns, while the rise in rates that the Fed has responded with – and has explicitly stated they expect to continue for the foreseeable future – has crushed the NPV’s of equities, and the mark-to-market value of bonds. As a result, an advisor seeking to maintain the alpha they have been able to generate with a passive and diversified 60/40 portfolio, may want to look at an allocation to alternative assets, including Global Macro, Real Estate, Multistrategy, Equity Market Neutral, Leveraged Buyout, and Private Credit.