Introduction

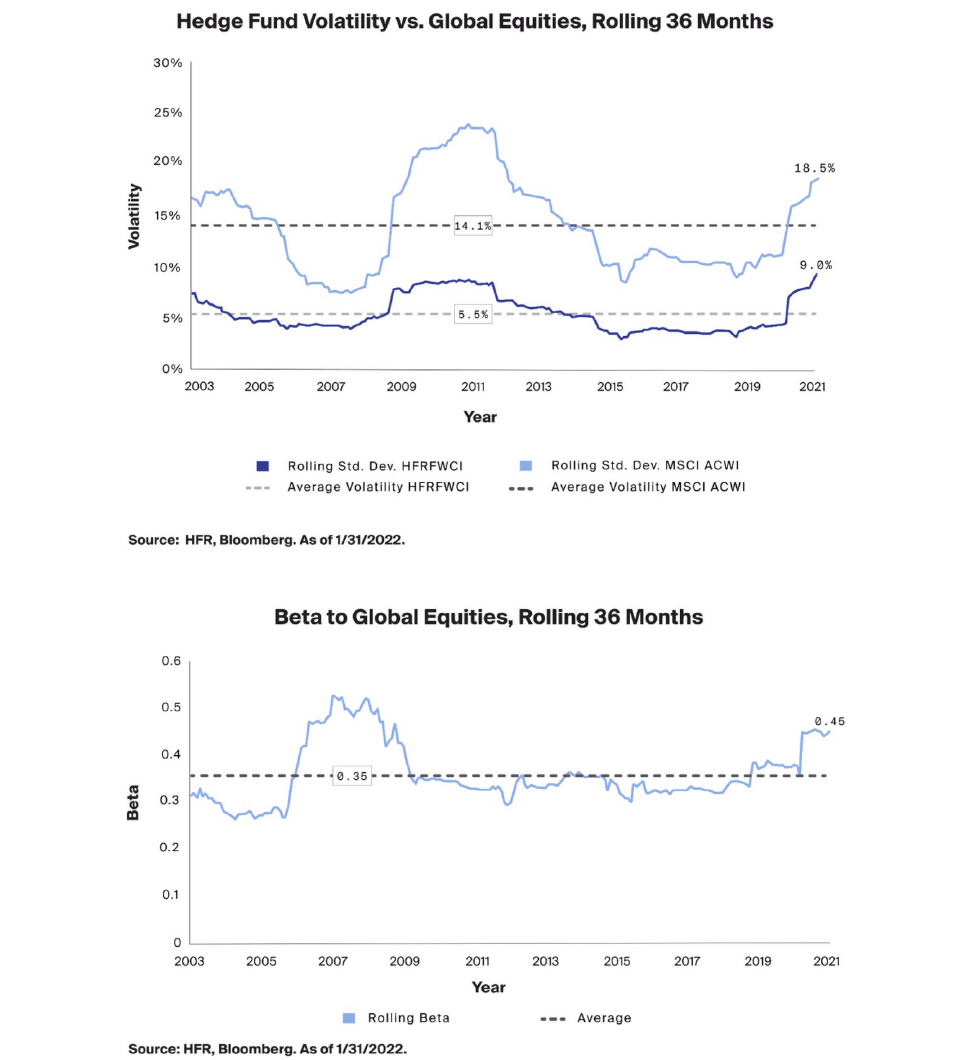

Market volatility is inherent to all asset values in financial markets and measures the price fluctuations of an asset or portfolio. Common causes of market volatility may include cyclicality, market speculation, and unexpected events. During times of increased market volatility, risk-averse investors are often attracted to assets or strategies that seek to provide downside protection yet remain capable of generating positive returns.

Hedge funds, a collection of heterogeneous investment strategies, encompass this core value proposition by seeking returns from alternative risk factors while limiting the influence of general market volatility. Across the hedge fund landscape, individual strategies tend to have highly disparate risk/return profiles. However, specific strategies, such as managed futures, global macro, multi-strategy, and relative value, may be particularly effective in combating market volatility as they can be less sensitive to equity market risk.

While hedge funds are not a panacea for overall market volatility, they can be a powerful portfolio diversifier, leading to higher risk-adjusted returns and greater protection against market drawdowns.

Why Hedge Funds?

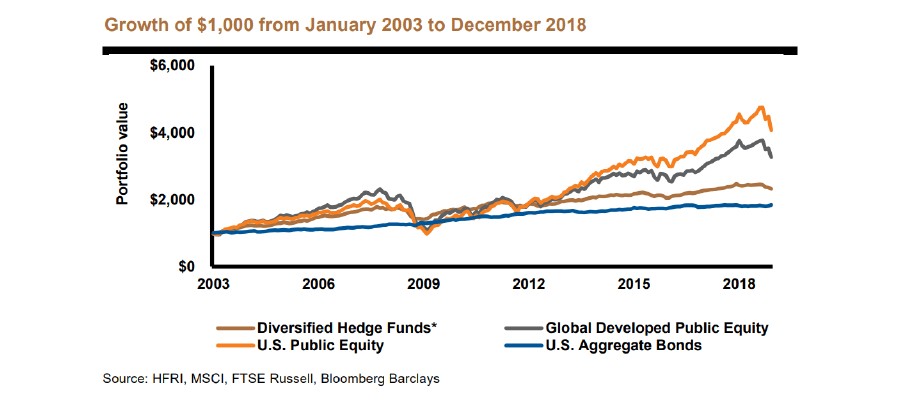

Some institutional investors, such as pension funds, sovereign wealth funds, and family offices, have long sought to utilize hedge funds to potentially unlock several key hedge fund benefits, including higher risk-adjusted returns and portfolio diversification. Because hedge funds generally rely less on the direction of capital markets and more on alternative return drivers, a hedge fund return stream is more likely to exhibit a lower correlation to public markets. The exhibit below illustrates the growth of $1,000 from January 2003 to December 2018 for four different portfolios. According to this chart, the U.S. Public Equity portfolio reportedly exhibited the strongest performance, resulting in higher portfolio gains over the provided period.

Despite this, some investment professionals would rightly argue that a direct comparison of absolute return hedge funds to long-only public market returns, such as the S&P 500 Index, is not an apples-to-apples comparison. Such comparisons do not tell the whole story, and it could be helpful to evaluate investment performance by using a framework that views a performance return relative to the volatility of its return stream.

Sharpe Ratio

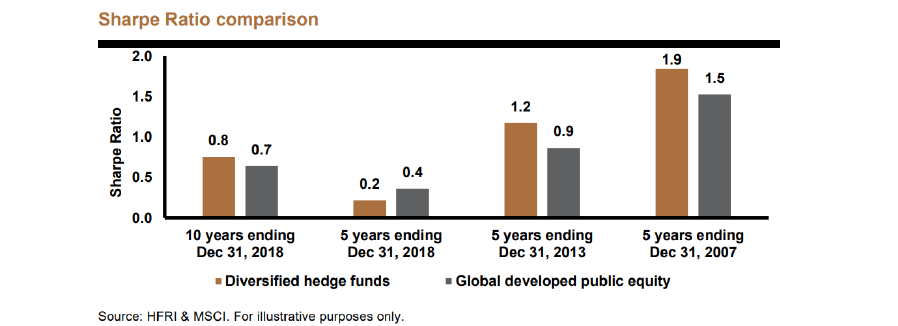

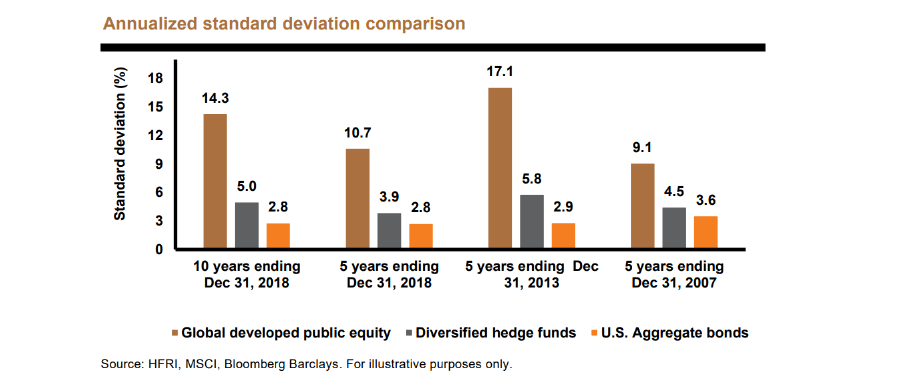

The Sharpe ratio is one of the most widely used methods for calculating risk-adjusted returns. According to Investopedia, the Sharpe ratio is defined as the ratio of the average return earned in excess of the risk-free rate per unit of volatility or total risk. In three of the four time periods illustrated below, the diversified hedge fund portfolio reportedly exhibited a higher Sharpe ratio than its globally developed public equity counterpart. The greater a portfolio’s Sharpe ratio, the higher its risk-adjusted performance.

While the Sharpe Ratio has its own limitations when evaluating performance, it is critical in bringing the volatility of returns into focus. As evident below, a public equity investor had to endure far greater price volatility to achieve relative performance during these time periods.

Capture Ratio

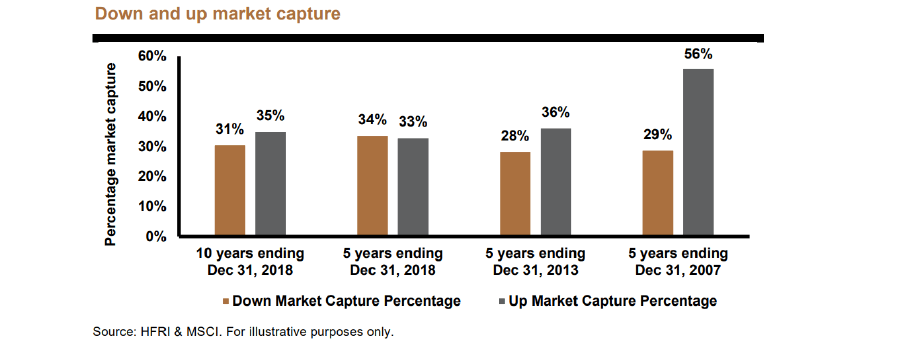

During heightened market volatility, investors tend to seek assets or strategies that provide downside protection yet remain capable of generating positive returns.

As such, in part, strategies can be evaluated by assessing their capture ratio or ratio of up-market capture to down-market capture.

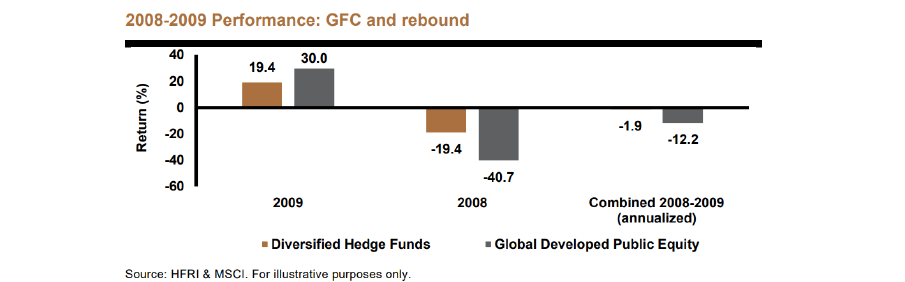

The capture ratio can also be viewed using specific periods of heightened market volatility, such as the Great Financial Crisis in 2008.

The exhibit below illustrates that globally developed public equity markets returned -40.7% in 2008, while a diversified hedge fund portfolio returned -19.4%. The following year, global equities returned 30%, while diversified hedge funds returned -19.4%. Over this period, the global public equity portfolio annualized at -12.2%, whereas the diversified hedge fund portfolio outperformed, annualizing at 1.9%.

Beta

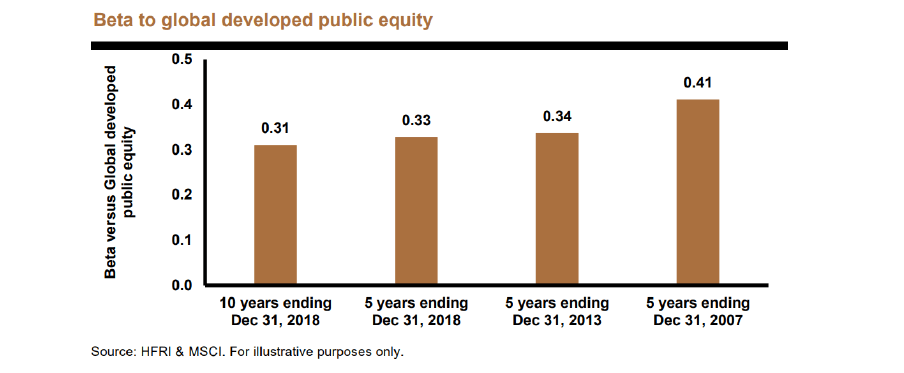

The equity beta statistic is best understood as a measure of volatility for the return stream of one asset relative to the return stream of another.

In many cases, asset volatility is measured relative to the S&P 500 Index. As illustrated below, a diversified hedge fund portfolio beta is expected to be less than 1/2 of the public equity market beta during the time periods shown below.

Hedge Funds Strategies

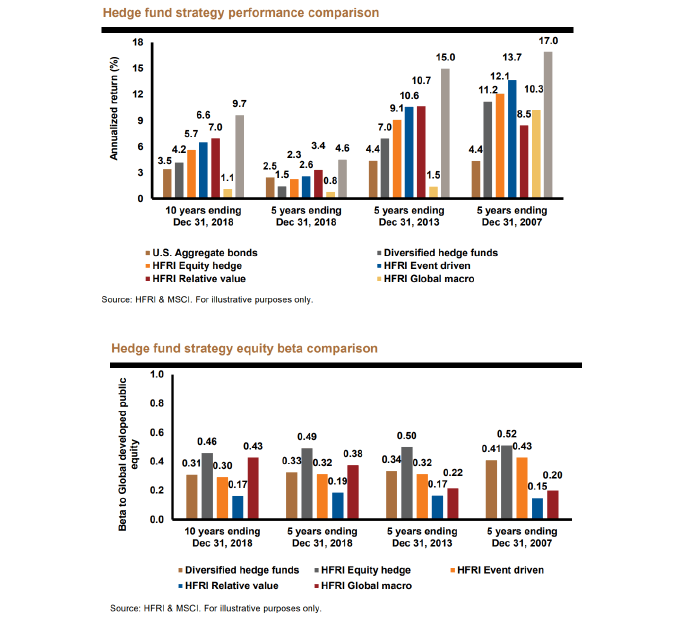

Market volatility is inherent to all asset values in financial markets and is a measure of the As to be expected, not all hedge fund strategies are created equal. The below charts illustrate the difference in annualized return and beta for different hedge fund strategies over the time periods provided.

While the results above vary meaningfully over the different time periods, investors can still use the above set of risk/return profiles in assessing the results, expectations, and objectives of various hedge fund strategies.

Risks & Limitations

Hedge funds are an actively managed strategy where an investor’s skill in manager selection and strategy allocation is critical to success. Despite the fund objective, a poorly executed strategy will fail to perform in all market environments.

Investors must be mindful that market volatility is to be expected. However, Black swan events, characterized by their extreme rarity and severe impact, can and will occur. These events can cause catastrophic damage to an economy and markets. Any reliance on standard forecasting tools can fail to predict and potentially increase vulnerability by offering a false sense of security.

But even absent a black swan event, there is always a risk to investors that any potential hedge fund benefit sought is not achieved. As a result, they may not get back the amount originally invested. Hedge fund investing is speculative and involves a high degree of risk. There is no assurance that one or more hedge fund investment strategies will not be exposed to risks of significant investment and trading losses, and no one asset or strategy can be assumed to outperform during all market environments. Any strategy that performed well during a previous environment may not perform the same during a subsequent one.

Conclusion

Market volatility is a measure of price fluctuations of an asset or portfolio. For most asset classes, there is no escaping market volatility. During difficult market environments, investors seek strategies that can help insulate and protect their portfolios. Hedge funds are not a panacea for overall market volatility, but they have been at times a powerful diversifier, leading to higher risk-adjusted returns and greater protection against market drawdowns.

While there is no assurance that one or more hedge fund investment strategies will not expose investors to risks of significant investment and trading losses, through a diversified collection of alternative risks and a disciplined risk-management approach, well-constructed hedge fund exposures may help investors protect their portfolios during times of heightened market volatility.