February Market Summary

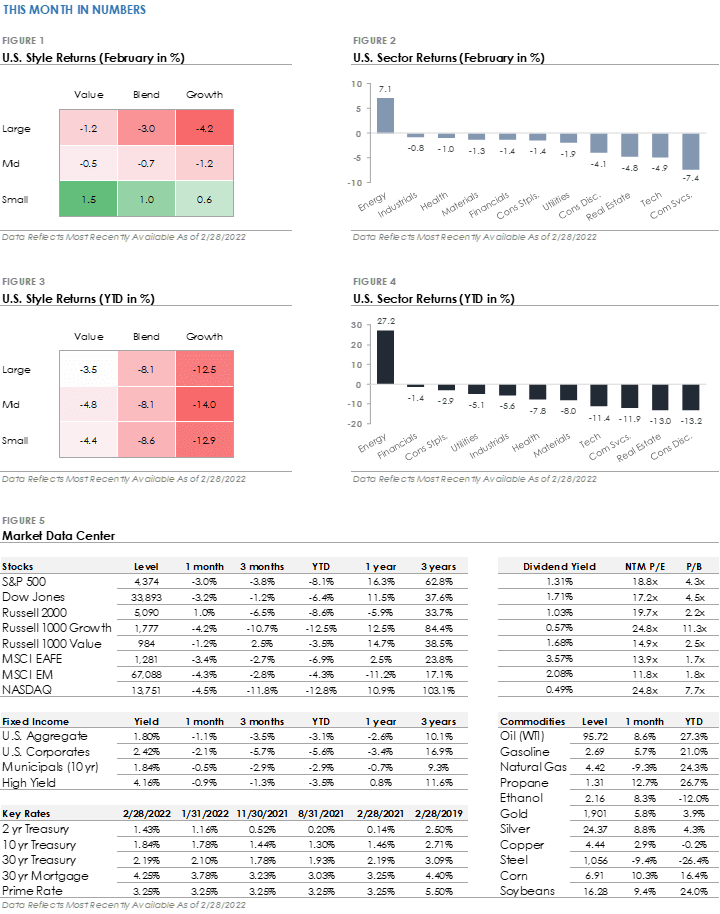

- The S&P 500 Index produced a -3.0% total return during February, underperforming the Russell 2000 Index’s +1.0% total return.

- For the second consecutive month, Energy was the only S&P 500 sector to post a positive return. Communication Services was the worst-performing sector during February as Facebook declined more than -30%, and Technology was the second-worst performing sector as rising yields continue to hurt Growth stocks.

- Corporate investment grade bonds generated a -2.1% total return, underperforming high-yield bonds’ -0.9% total return.

- The MSCI EAFE Index of global developed market stocks returned -3.4% during February, outperforming the MSCI Emerging Market Index’s -4.3% return.

Global Stock Markets Decline as Geopolitical Tensions Rise in Europe

The stock market’s bumpy ride continued during February. Last month’s top news story was rising geopolitical tensions and Russia’s invasion of Ukraine. The headlines briefly pushed the S&P 500 into correction territory, defined as a -10% or more significant price decline, before US stocks recovered some of their losses. International equities also traded lower as investor risk appetites declined due to rising geopolitical risk. In the commodity market, energy prices increased amid fears that geopolitical tensions would disrupt oil output and worsen an already under-supplied oil market.

Back in the US, markets prepared for the Federal Reserve to raise interest rates. The headline Consumer Price Index, which measures inflation, rose +7.5% year-over-year during January 2022. It increased from December 2021’s +7.1% and the fastest annual increase since 1982. Treasury yields moved higher for a second consecutive month, indicating that investors expect the Federal Reserve to aggressively raise interest rates to ease inflation pressures. Rising yields led to a second straight month of negative credit returns and Growth stocks underperforming Value stocks.

Federal Reserve Meeting Charts the Course for the Rest of 2022

The Federal Reserve held its March 2022 meeting from March 15th-16th, and on March 16th announced that it would raise interest rates by +0.25%. It was widely anticipated that the Federal Reserve would raise interest rates by one of two amounts ― either +0.25% or +0.50%. Although the 0.25% difference between the two options may seem insignificant, we believe the decision charts the course for the remainder of 2022. With the Federal Reserve’s decision to only raise the interest rate by +0.25%, investors may interpret the smaller increase as a sign the Federal Reserve will keep interest rates lower for longer, inferring economic growth will be less impacted. If the Federal Reserve would have raised the interest rate by +0.50%, investors may have viewed the faster pace of interest rate increases as more likely to slow economic growth and potentially trigger a recession.

The Storm Clouds Today Continue to Build

While the Fed may be in fact “fiddling while Rome burns,” we are actively positioning ourselves for what looks to be a rocky outlook going forward. Our current posture has us defensive, with a skew towards commodities in this inflationary environment. Although we are in no means in the “permabear” camp, there are definite signs that we’re looking at a very different market today than we ever have in the recent past.

GMO’s Jeremy Grantham gave his take on things earlier this year, which I found fascinating. Here are a few excerpts:

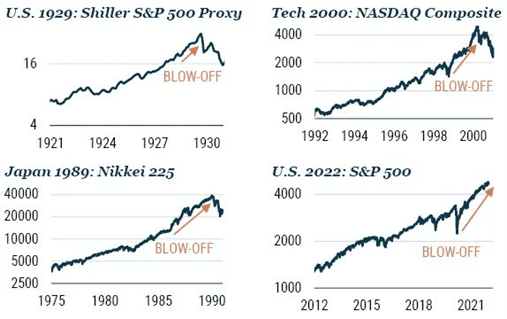

“Today in the U.S. we are in the fourth superbubble of the last hundred years. Previous equity superbubbles had a series of distinct features that individually are rare and collectively are unique to these events. In each case, these shared characteristics have already occurred in this cycle.

The penultimate feature of these superbubbles was an acceleration in the rate of price advance to two or three times the average speed of the full bull market. In this cycle, the acceleration occurred in 2020 and ended in February 2021, during which time the NASDAQ rose 58% measured from the end of 2019 (and an astonishing 105% from the Covid-19 low!).

The final feature of the great superbubbles has been a sustained narrowing of the market and unique underperformance of speculative stocks, many of which fall as the blue-chip market rises. This occurred in 1929, in 2000, and it is occurring now. A plausible reason for this effect would be that experienced professionals who know that the market is dangerously overpriced yet feel for commercial reasons they must keep dancing prefer at least to dance off the cliff with safer stocks. This is why at the end of the great bubbles it seems as if the confidence termites attack the most speculative and vulnerable first and work their way up, sometimes quite slowly, to the blue chips.

The most important and hardest to define quality of a late-stage bubble is in the touchy-feely characteristic of crazy investor behavior. But in the last two and a half years there can surely be no doubt that we have seen crazy investor behavior in spades – more even than in 2000 – especially in meme stocks and in EV-related stocks, in cryptocurrencies, and in NFTs.

This checklist for a superbubble running through its phases is now complete and the wild rumpus can begin at any time.

What is new this time, and only comparable to Japan in the 1980s, is the extraordinary danger of adding several bubbles together, as we see today with three and a half major asset classes bubbling simultaneously for the first time in history. When pessimism returns to markets, we face the largest potential markdown of perceived wealth in U.S. history.”

Later in the piece, Mr. Grantham discusses the final phase of the superbubble mania, the “blow-off top”:

“The penultimate phase of major bubbles has been characterized by a “blow-off” – an accelerating rate of stock price growth to two or three times the average of the preceding bull market. This pattern was shown as clearly as any of history’s other great superbubbles in 2020 (see Exhibit 4).”

Exhibit 4: Stock Market Superbubbles Have Blow-off Tops

What I find most valuable about our strategy, above all else, is its flexibility to respond and move us safely where we need to be when things get dicey- as they are today. Sometimes, cash is king, and we’ll sit off to the sidelines for now until we see some stability return.

This Month in Numbers

Disclosures

CF Financial (“RIA Firm”) is a registered investment adviser. Information presented is for educational purposes only intended for a broad audience. The information does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and are not guaranteed. CF Financial has reasonable belief that this marketing does not include any false or material misleading statements or omissions of facts regarding services, investment, or client experience. CF Financial has reasonable belief that the content as a whole will not cause an untrue or misleading implication regarding the adviser’s services, investments, or client experiences. Past performance is not indicative of future performance.

CF Financial is not giving tax, legal or accounting advice, consult a professional tax or legal representative if needed.