Accelerating inflation, monetary tightening, slowdowns in GDP growth, and widening credit spreads: for the fixed income investor, the future is not looking bright. As any savvy bond trader or investor knows, the price of a fixed-rate investment is inversely related to its yield. But across the universe of fixed income assets, additional factors such as inflation and credit spreads (the difference in yield between a risk-free asset, like US Treasuries, and another debt security) all contribute to the mark-to-market value of a security. With the Federal Reserve making clear its expectations for inflation to remain stubborn, and in turn, a continued path of rate hikes likely for the foreseeable future, economists around the globe are bringing back a retro term from the ‘70s & ‘80s: Stagflation, the double whammy of sustained levels of high inflation coupled with slow or negative economic growth. So, in a stagflationary environment, where fixed-income assets ranging from U.S. Treasuries to Corporate Bonds, to Asset-Backed Securities are all struggling to perform, where can some investors looking for the “40” in a traditional 60/40 portfolio turn? In seeking stable cash flows and low price volatility, some investors in this environment may want to consider a potential solution: Private Credit Funds.

The Economic Landscape

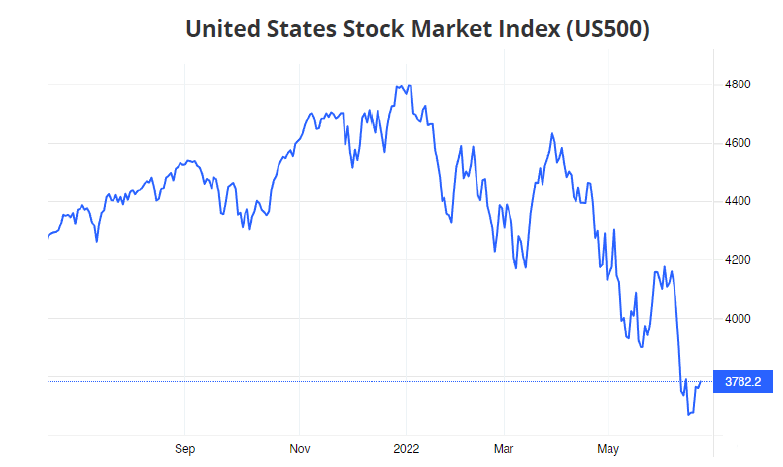

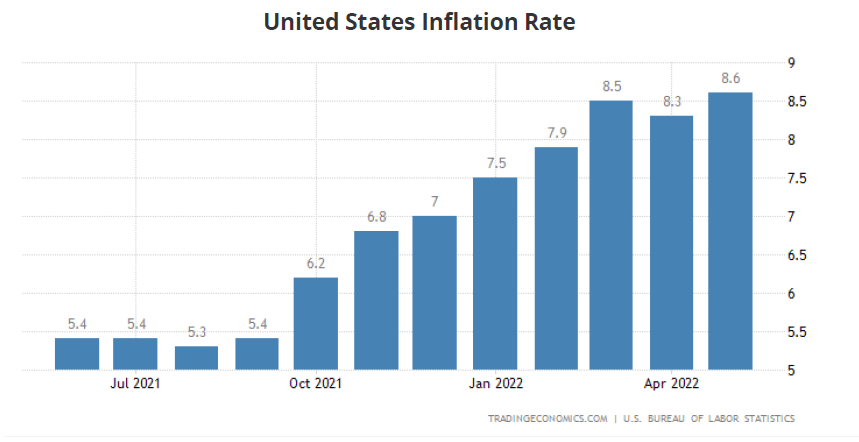

As we all have seen in 2022, put simply, large aspects of the economy are not looking so great. Markets are plummeting, with the S&P down over 1,000 points since Dec 31, 2021, while inflation is up 1.6 percentage points since December of 2021, reaching a painful 8.6% through May.

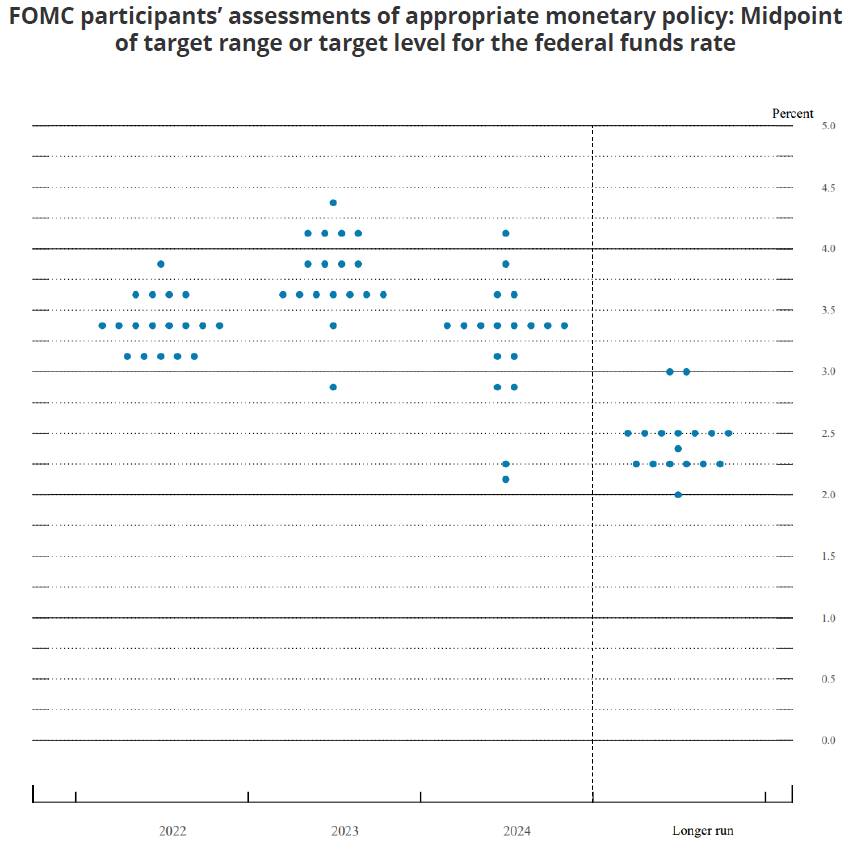

Meanwhile, the Federal Funds rate is up 0.75% year to date, with all 18 participants of the Board of Governors from this month’s Federal Open Market Committee Meeting projecting rates of at least 3% by the end of the year, and more than half expecting at least 3.375% by the end of the year. At the same time, the Atlanta Fed’s GDPNow forecast of Q2’22 GDP growth has plummeted in recent weeks, with zero estimated growth for the quarter.

With the Fed explicitly stating they will target slower economic growth to vanquish the beast of inflation, many are preparing for the potential of low or negative economic growth, and continued inflation as the tightening of monetary policy works its way through the financial system. So, with continued economic turmoil expected, how might fixed income markets weather the coming storm?

A Fixed Income Overview

To understand the fundamentals of fixed income investing, it is important to be aware of the dynamics that affect the price action of fixed income assets. For most securities, the most influential factors on pricing are their yield and credit quality, often represented in price terms

as the credit spread, or the difference between the yield on a risk-free asset and the security’s yield. Given that a bond’s price is inversely correlated to its yield, the current high inflation/rising rate environment is not conducive to the positive price action of traditional fixed-income assets.11 But in this environment, there are multiple types of securities outside of the traditional fixed-rate assets of most corporate and treasury bonds. PIMCO, one of the world’s largest asset managers and fixed income investors, recently highlighted the benefits of U.S. Treasury Inflation-Protected Securities (TIPS) – bonds that, as the name suggests, have a variable rate of interest linked to prevailing U.S. inflation rates, that offer a degree of protection. Additionally, in the equity markets, there include several fixed-income-like assets, as well as

bonds like Asset-Backed Securities, and of course, Private Credit.

- Master Limited Partnerships (MLPs): a hybrid legal entity commonly used to monetize oil & gas pipeline fees, and therefore structured with long-term and stable cash flows and many of the same tax benefits as traditional bonds.

- Real Estate Investment Trusts (REITs) and Business Development Companies (BDCs): a type of closed-end fund that invests in small and medium enterprises, are also commonly structured with high dividend payouts owing to the requirement that they distribute over 90% of profits to shareholders, and also offering fixed-income like returns.

- Asset and Mortgage-Backed Securities: more esoteric bonds with many floating-rate structures that alleviate some of the overall market interest rate volatility that can crush fixed-rate assets.

However, there remain many problems with these types of investments, ranging from low returns in a post-inflationary environment (TIPS), significant industry concentration (MLPs and some BDCs), price volatility (REITs, MLPS), lack of diversification (ABS & MBS), widening credit spreads (MLPs, BDCs, REITs, and ABS). So, in an economic environment we have not seen in over a generation, where can an investor seeking shelter from rate volatility, rising interest rates, high inflation, and deteriorating credit spreads look?

The World of Private Credit

In times of rising interest rates/high inflation, floating-rate bond structures have been shown to alleviate the yield effect on a bond’s price. In a highly price volatile market environment, assets that do not price on a daily mark-to-market basis can help avoid the daily stress of price drops. And in a risk-off market with widening credit spreads, diversification is an important aspect to limit the risks of any one of the assets’ credit quality deteriorating. This is where Private Credit funds may be able to fill the gap.

Private Credit funds are private funds that invest in privately originated debt, often illiquid but offer higher yielding loans, with the goal of providing diversification across hundreds and sometimes thousands of loans, across the spectrum of illiquid, esoteric, distressed debt, and middle-market loans. Private Credit funds typically originate and purchase the debt of companies that are too small to access traditional capital market origination, often providing an illiquidity premium on the rates the underlying borrowers pay.

In our piece last year, “Defining Private Credit and Its Use Cases”, we elaborate further on the structures and strategies. But for the investor looking for the “40” in their 60/40 equity/debt portfolio, the potential benefits of Private Credit funds boil down to three things: 1) floating-rate structure, 2) quarterly pricing, and 3) diversification. Because of the nature of early-stage, middle-market, and distressed companies, private and leveraged loans are typically issued on a floating, or variable rate, basis (e.g., Three Month LIBOR), with a fixed spread against a variable benchmark rate (e.g., Three Month Libor plus 10%). As a result, as the Federal Reserve continues to raise interest rates, the present value of the cash flows on any given floating-rate loan adjusts accordingly, in turn softening the price effect in a rising rate environment. Additionally, most Private Credit funds price (and distribute cash) on a quarterly basis.

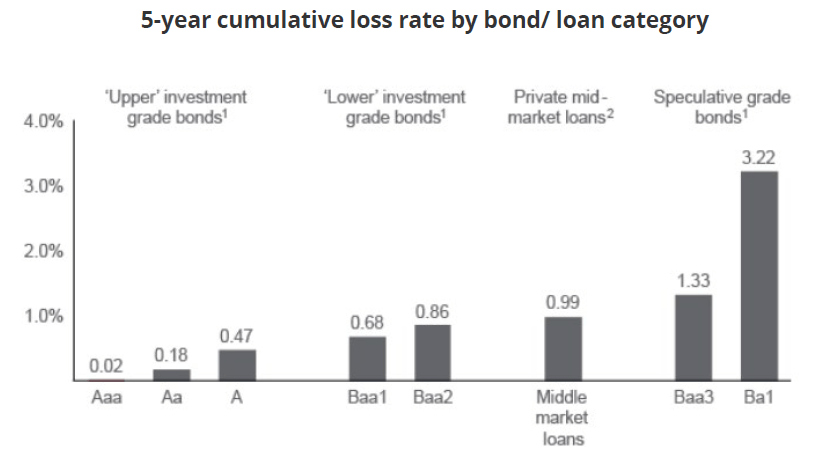

These quarterly pricings can be especially helpful in times of very high volatility, as investors do not suffer the daily peaks and troughs they otherwise would in holding publicly traded bonds like treasuries or corporates. Arguably most importantly, Private Credit funds typically invest in a pool of hundreds and often times thousands of loans and other debt securities, and can therefore be very well diversified across the industry, duration, debt structure, location with the capital structure, and more. For what is generally considered an illiquid asset class, the investment approach of Private Credit has yielded superior returns and lower default and loss rates, historically achieving superior loss rates to the BBB- rated securities. Even at the peak of the pandemic, default rates in private debt peaked at 8.1% in Q2’20, before quickly falling back to 1.04% by year-end 2021.

It is, therefore, little surprise that many of the largest institutional investors have increased their allocations to Private Credit. Since the 2008 financial crisis, the market overall has boomed from being virtually non-existent to now becoming a reported 1.2 trillion dollar asset class. Pension funds, in particular, seeking a stable source of alpha over risk-free rates, have upped their investment in the space. The two largest U.S. Pension Funds, Calpers and CalSTRS have set a target of a 5% allocation to the asset class, with CalSTRS allocation representing nearly 40% of its total fixed-income investments.

Conclusion

While the market environment today presents many challenges to investors across both equity and debt, rising rates and inflation present a particular problem for fixed-income investors. While no strategy or investment can absolve an investor of all potential market risks, floating interest rates, and diversification can be key to softening some of the macroeconomic hits all fixed-income securities currently face. With Private Credit funds offering immense diversification, continued strong performance of the underlying borrowers even in a deteriorating economy, and interest rates that move in line with the prevailing market benchmarks, many of the traditional negative factors in fixed income are moot. For an investor who understands the risks and is willing to take the illiquidity premium and sacrifice short-term access to funds for the potential of long-term, stable cash flows that have historically been superior to assets of similar credit quality, Private Credit funds may be part of their solution.