November 2022 Market Summary

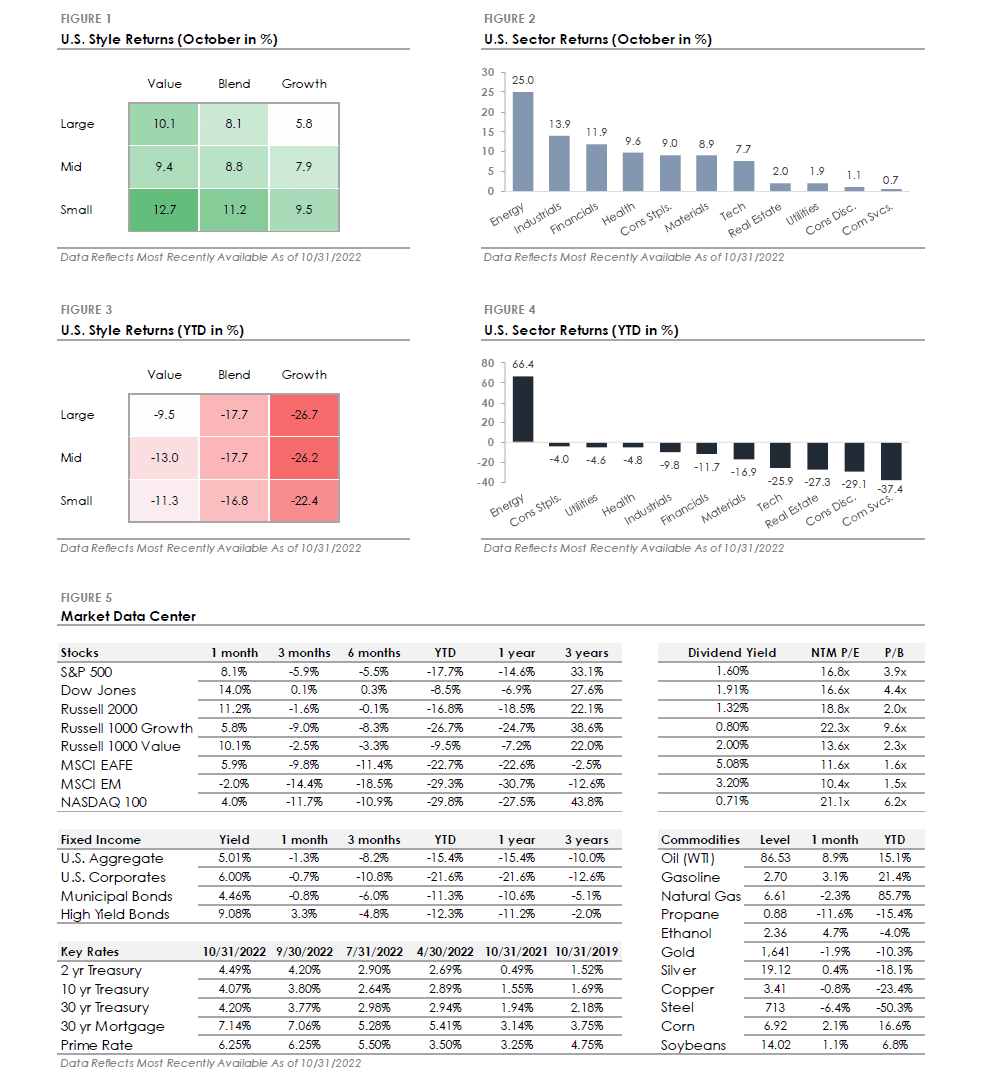

- The S&P 500 Index returned +8.1% during October, underperforming the Russell 2000 Index’s +11.2% return.

- Energy (+25%) was the top-performing sector as the price of oil rose +8.9%, with Industrials (+13.9%) and Financials (+11.9%) the second and third best performers. Defensive sectors underperformed the market rally during October, with Real Estate (+2%), Utilities (+1.9%), and Communication Services (+0.7%).

- Corporate investment grade bonds generated a -0.7% total return, underperforming corporate high-yield bonds’ +3.3% total return.

- The MSCI EAFE Index of global developed market stocks returned +5.9% during October, outperforming the MSCI Emerging Market Index’s -2% return.

Equity Market Rebounds After September Sell-Off

Stock markets remained volatile during October, once again changing direction as investors shifted their views. After declining -9.2% during September, the S&P 500 gained +8.1% during October. Likewise, the Russell 2000 Index of small-cap stocks reversed direction, returning +11.2% during October after declining -9.7% during September. High-yield corporate bonds outperformed in the credit market as credit spreads tightened, while investment-grade bonds produced a slight loss as Treasury yields continued to increase. Comparing September and October performance trends highlights the sharp reversal in market sentiment and the resulting risk-on-market rally.

Uncertain Federal Reserve Policy Continues to Drive Market Volatility

Increased stock and bond market volatility is attributed to uncertain Federal Reserve policy. Why? The terminal rate, which represents the forecasted rate at which interest rate hikes will stop, constantly changes as new information is available. A higher terminal rate is more restrictive on economic activity and implies lower stock valuations, while a lower terminal rate is less economically restrictive and implies higher stock valuations. As the market’s terminal rate forecast moves up and down, stocks and bonds also move to price in the new terminal rate. It’s a messy process.

The October equity market rally was driven by the concept of a ‘Fed pivot,’ defined as a reversal in Federal Reserve policy. The pivot concept gained steam recently as Fed officials started to debate when and how to stop raising interest rates, which the market interpreted as fewer rate hikes and a lower terminal rate. Stocks traded higher as the market priced at a lower terminal rate. Is the new projected terminal rate correct? It’s difficult to say, and the market likely isn’t done guessing. Until the direction of Fed policy is more apparent, the market’s projected terminal rate will continue to fluctuate. This means volatility could remain elevated in the coming months.

This Month in Numbers

Disclosures

CF Financial (“RIA Firm”) is a registered investment adviser. Information presented is for educational purposes only intended for a broad audience. The information does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and are not guaranteed. CF Financial has reasonable belief that this marketing does not include any false or material misleading statements or omissions of facts regarding services, investment, or client experience. CF Financial has reasonable belief that the content as a whole will not cause an untrue or misleading implication regarding the adviser’s services, investments, or client experiences. Past performance is not indicative of future performance.

CF Financial is not giving tax, legal or accounting advice, consult a professional tax or legal representative if needed.