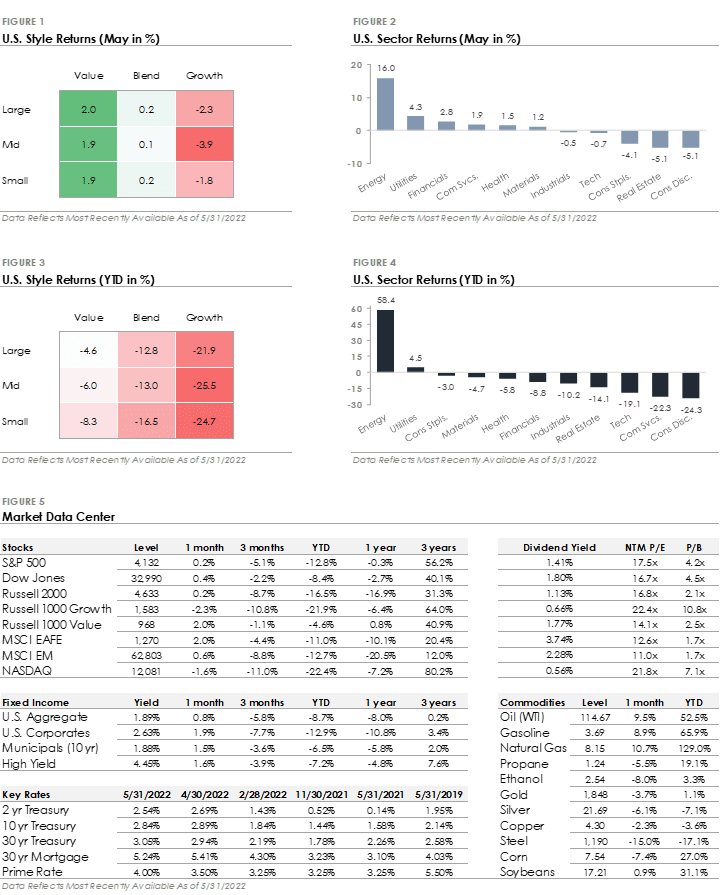

May Market Summary

- The S&P 500 Index produced a +0.2% total return during May, in line with the Russell 2000 Index’s +0.2% total return.

- Energy was the top performing S&P 500 sector during May, returning +16% as the price of WTI Oil rose +9.5%. Consumer Discretionary was the worst performing sector, returning -5.1% as Amazon and Tesla both traded lower. Consumer Staples was the third-worst performing sector, returning -4.1% as weak earnings weighed on retail stocks (refer to comments below).

- Corporate investment grade bonds generated a +1.9% total return, slightly outperforming corporate high yield bonds’ +1.6% total return.

- The MSCI EAFE Index of global developed market stocks returned +2% during May, outperforming the MSCI Emerging Market Index’s +0.6% return.

Equity & Credit Markets Pause After April’s Selloff

The S&P 500 was flat during May. While the +0.2% return was a welcome sight after April’s -8.8% decline, the S&P 500’s daily price movements remained volatile with the index down more than -5% at its lowest point. In the credit markets, corporate bonds produced positive total returns as Treasury yields stabilized.

Looking at the big picture, Federal Reserve policy and inflation remain top of mind for investors. The Federal Reserve raised its benchmark interest rate +0.50% at May’s meeting and is expected to follow-up with +0.50% increases at both the June and July meetings. Separately, data showed inflation accelerated +8.3% year-over-year during April 2022 and remains near a 40-year high. The Federal Reserve wants to see evidence inflation pressures are easing, which leaves investors debating how far and fast the central bank will increase interest rates to combat high inflation. The near-term investment outlook remains particularly uncertain as the market searches for direction.

Retailer Earnings Underscore Inflation’s Impact on Businesses & Consumers

Walmart and Target both reported underwhelming first-quarter 2022 earnings. Both retailers were caught flat-footed by not raising prices fast enough in response to increased supply chain costs. The two retailers also saw their inventories grow by +30%, reflecting price increases by their vendors but also softening consumer demand for discretionary purchases, such as home goods and apparel. Walmart’s CEO said, “… the rate of inflation in food pulled more dollars away from GM [general merchandise] than we expected as customers needed to pay for the inflation in food.” Looking ahead, the two retailers signaled the potential for additional price increases. Target’s CEO said, “… you should expect us to surgically pass along costs where appropriate.”

The earnings reports caused retail stocks to selloff and highlighted three key themes. First, inflation pressures are strong and catching companies off-guard. Walmart revised its forecasted earnings lower, while Target did not provide an update. Second, inventories ballooned after the retailers restocked at higher prices and consumers shifted spending due to rising prices. It could take multiple quarters to work through the excess inventories. Third, additional price increases may be coming as companies focus on maintaining profit margins. The three themes demonstrate inflation’s worrying impact, which we will continue to monitor.

It’s important to note here that the inventories of both Walmart and Target continue to increase. In fact, inventories are growing at the fastest rate since 2000. Burgeoning inventories will result in fewer new orders, ultimately weighing on the manufacturers of their goods. Inflation will continue to put pressure on retailers. Let’s face it, consumers must spend more money on food, gas, and other necessities, leaving less money available for many discretionary products that stores like Target and Walmart sell. At the same time, wages, transportation, and inventory costs are rising rapidly. Retailers are increasingly struggling to pass on those higher costs to their customers.

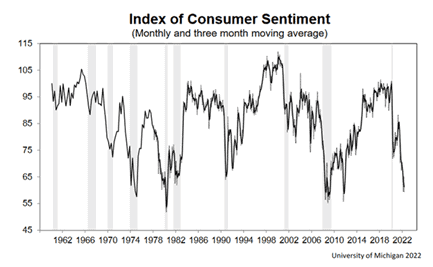

Plunging Consumer Sentiment

As markets roil and inflation soars, it’s not surprising to see that our current turmoil is having a noticeable effect on consumers. Personal consumption accounts for approximately two-thirds of economic activity. Accordingly, consumer sentiment, which is primarily a factor of the financial state of consumers, is an important indicator to follow. It’s not surprising then to find the University of Michigan Consumer Sentiment Survey tracking near its all-time lows of the last 60 years, as shown below.

Looking Forward in the Face of Turmoil: Don’t Forget QT!

For the second time in the past decade, the Fed will try – and most likely fail – to shrink its balance sheet to some “reasonable” size, a process known as Quantitative Tightening 2. What this means in theory is that the Fed’s balance sheet will shrink by $95BN or so every month for the foreseeable futures as existing US Treasuries and Mortgage-Backed Securities mature. When you consider that the markets meteoric rise over the past few years has been in lockstep with M2 money supply this does not bode well for future gains in equities. Couple that with a policy of tightening into what may already be a recession underway and you have a recipe for more disaster from the Fed. It’s not surprising then to find consumers with such a bleak outlook.

To that end, we remain largely in cash again this month with just a smattering of exposure to some defensive and inflation-oriented names.

This Month in Numbers

Disclosures

CF Financial (“RIA Firm”) is a registered investment adviser. Information presented is for educational purposes only intended for a broad audience. The information does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and are not guaranteed. CF Financial has reasonable belief that this marketing does not include any false or material misleading statements or omissions of facts regarding services, investment, or client experience. CF Financial has reasonable belief that the content as a whole will not cause an untrue or misleading implication regarding the adviser’s services, investments, or client experiences. Past performance is not indicative of future performance.

CF Financial is not giving tax, legal or accounting advice, consult a professional tax or legal representative if needed.