Monthly Market Summary

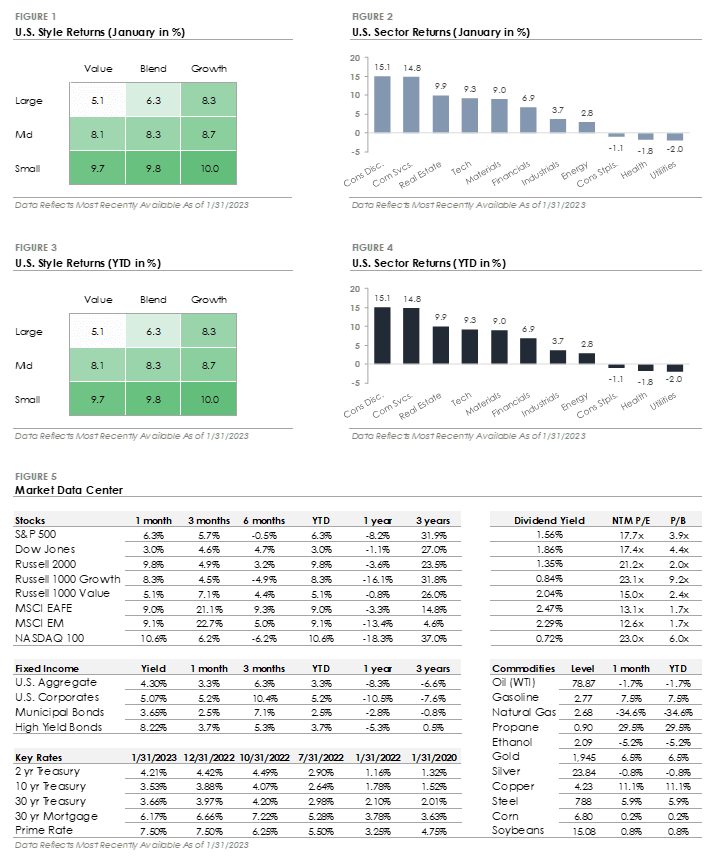

- The S&P 500 Index returned +6.3% in January, underperforming the Russell 2000 Index’s +9.8% return. 2022’s underperforming sectors were the top performers in January, while defensive sectors posted negative returns.

- Corporate investment grade bonds generated a +5.2% total return, outperforming corporate high-yield bonds’ +3.7% total return. The positive bond returns occurred as Treasury yields declined across most of the yield curve.

- International stocks outperformed for a third consecutive month as the US dollar weakened. The MSCI EAFE Index of developed market stocks returned +9.0%, in line with the MSCI Emerging Market Index’s +9.1% return.

Fourth Quarter GDP Growth Slows but Remains Positive

The US economy grew at a +2.9% annual rate in the fourth quarter of 2022, down from the third quarter’s +3.2% annual rate. The growth was primarily driven by a resilient consumer, inventory restocking, and increased government spending, while businesses cut back their spending on equipment, and the housing market remained weak. While GDP growth was positive for a second consecutive quarter, the pace of economic growth slowed as the year ended. The US economy grew +1% year-over-year compared to the same quarter a year ago, a slowdown from the +5.7% year-over-year growth rate recorded in the fourth quarter of 2021.

The slowdown signals a return to a more normal pace of growth after 2021’s strong growth. Looking ahead to 2023, the US economy is forecasted to slow as the cumulative effect of higher interest rates takes hold. Economists are concerned the Federal Reserve’s efforts to curb inflation could trigger further spending cutbacks and job losses and tip the US into a recession.

Financial Conditions Loosen in Anticipation of 2023 Interest Rate Cuts

Financial conditions, which refer to the ease and cost of obtaining capital, loosened in January. The catalyst was the market’s anticipation of possible interest rate cuts in late 2023 due to a slowdown in economic activity. Treasury yields declined, corporate bond spreads tightened, and mortgage rates declined another -0.40%. Lower stock and bond market volatility, which reduces the level of perceived risk and encourages more investment activity, added to the loosening of financial conditions.

The Federal Reserve has expressed concern about the potential for loose financial conditions to undercut its efforts to bring inflation down. When financial conditions are loose, people are more willing to take risks and borrow money, which can lead to higher spending and demand for goods and services. This increased demand could increase prices, keeping inflation elevated and forcing the Federal Reserve to tighten further. Policymakers will keep a close eye on financial conditions as 2023 progresses.

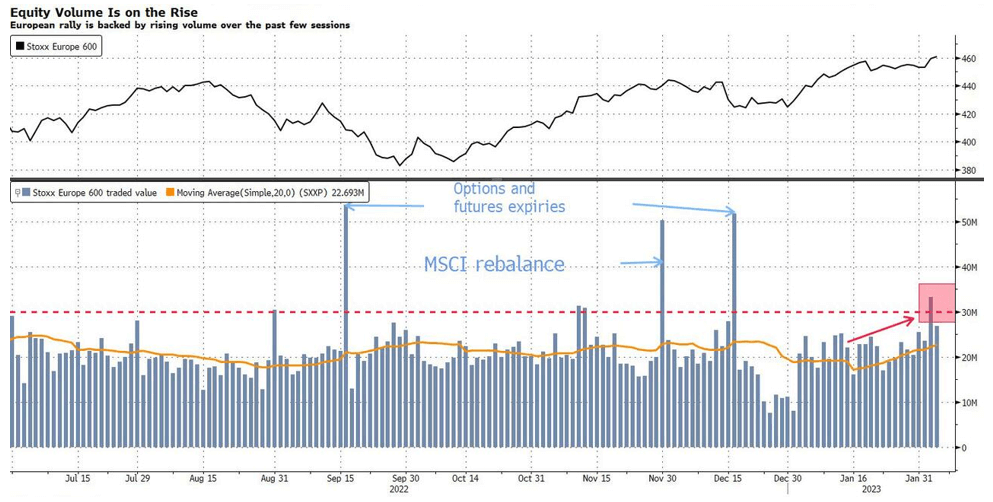

Dip Buying is Returning as Investors are Beginning to Emerge from the Sidelines

Receding inflation, increasing talk of a peak in bond yields, and a resilient economy suggest a soft landing can be achieved after all. This is causing traders to see the market conditions as decidedly glass half-full, and equity volumes are picking up. Still, while most investors have been reluctant to chase the rally and remain under-exposed to equities, that may change given the positive momentum.

Even outrageously strong US job data Friday — fodder for hawkish Federal Reserve policymakers — had no impact on European stock prices. The Stoxx 600 entered a bull market, and London’s FTSE 100 hit a record high.

Our Current View

Market behavior today centers around ignoring reality. This is a product of 40 years of Fed intervention in markets. When you constantly have somebody ready to bail out the market the first half second one person feels discomfort, it creates a foundation of irrational expectations from investors, namely that things are always better than they seem.

In my experience, I’ve listened to the relentless droning of pundits talking about how the market will always go up and how the United States will continue to be the world’s superpower, no matter what. Those statements are made with certainty, even though mathematically, none of these things are certainties, or for that matter, even likely to be true. Listening to the Wall Street ordained market prognosticators can lead you to disaster. We’ve built our model to take the guesswork out of the unknown. We invest where the trends and volume tell us.

The only way we can gauge market conditions is to continue to follow the data, objectively monitor the news, think critically, and apply our own trusted methods.

Currently, our portfolios are skewing towards equity, but recent volatility makes us more skeptical than we’d like to be. However, as the saying goes, “markets climb a wall of fear.” As the markets relentlessly gyrate in an absolute void of participants, we will adjust accordingly but closely monitor our exit trigger until the firm trend reestablishes itself.

This Month in Numbers

Disclosures

CF Financial (“RIA Firm”) is a registered investment adviser. Information presented is for educational purposes only intended for a broad audience. The information does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and are not guaranteed. CF Financial has reasonable belief that this marketing does not include any false or material misleading statements or omissions of facts regarding services, investment, or client experience. CF Financial has reasonable belief that the content as a whole will not cause an untrue or misleading implication regarding the adviser’s services, investments, or client experiences. Past performance is not indicative of future performance..

CF Financial is not giving tax, legal or accounting advice, consult a professional tax or legal representative if needed.